About Our Online Donation Service

Why we offer inmemory donations

Reach plc publishes obituary notices in over 110 regional newspapers, most of which also appear on its funeral notices website - funeral-notices.co.uk. Over 120,000 notices are published on this site per annum and it receives over a million visitors per month. Since July 2019 this has included an online donations service, allowing anyone placing a death notice to add an online collection. The service is managed by Donatis using their fundraising platform, which is fully integrated into our booking system and the funeral-notices.co.uk website.

Benefits to a Charity

funeral-notices.co.uk is by far the largest UK InMemory tribute site carrying a notice for almost one in every four deaths. Many mourners use the newspaper and its online pages to find out who has passed away and view the service details. As many of our notices are viewed thousands of times, it’s the best place to collect in memory.

Most funerals directors still collect donations in the traditional way and this offers them an easy option to add an online donations service at no cost. Our aim is to move donors away from offline donations (which create an administrative burden for the funeral director and reduce opportunities to add Gift Aid) to online giving - where typically 80% of donors opt to add Gift Aid. The Donatis fundraising platform gathers all the necessary donor information and provides it to the charity in the approved HMRC format.

How the Process works

Anyone can add the donation option to an obituary notice announcing the passing and including details of the funeral arrangements. This is what is known as a ‘main notice’.

To add it to your notice, simply select death notice from the classifications then in the relationship field choose ‘Funeral Arrangements / Funeral Director’.

The notice can be placed online or via our call centre. Our booking system automatically detects if the notice text contains a charity name and offers to link the collection to the appropriate charity. All notices are checked for accuracy of content before being published, and a copy sent to the person placing the notice for them to check the content and the charity(ies) selected.

All notices that have a collection show the charity detail, as well as the total raised to date and Gift Aid claimed. Donations can be made for 5 weeks following the date of booking and while the collection is open a donate button is shown. When the collection is closed this button is removed from the notice (which remains online indefinitely), the viewer is told the final collection totals and invited to donate directly to the charity(ies).

The online donation form contains a clear statement of the costs of the service before the donors enter any payment details. The following message is shown above the card payment fields: “The costs of providing this service are met through an administration charge of 4% of the total donated excluding Gift Aid, in addition to the card processing fees (currently 1.3% plus 20p for European cards and 2.9% plus 20p for non-European cards).”

- 3. Donation Gift Aid Election

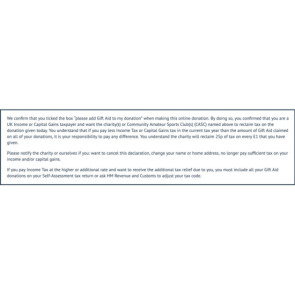

The Gift Aid section of the donation form contains the latest HMRC model declaration:

The donor must select a declaration to add or not add gift aid (they cannot continue without clicking one of the statements), which meets published HMRC requirements for an online declaration system. On completion of the payment, the confirmation page summarises the donation information. If gift aid has been elected, it repeats the declaration. In HMRC terminology this “…acts as an online confirmation of declaration…”:

Finally, an acknowledgement email is sent immediately to the donor, confirming receipt & thanking them. If they added gift aid, the above text is repeated in the email, and they are informed how they can contact Reach in the event they added it in error. This email acts as a written confirmation of their declaration and meets HMRC best practice for a receipt to be sent.

If the donor elects to add gift aid, the report sent to the charity when the collection has closed records the fact and discloses the full address and email address of the donor.

- 4. Obtaining charity bank information ready to pay when the collection closes

As soon as any collection receives a donation, the Donatis platform checks that banking information has previously been supplied by the charity so a BACS payment can be made when the collection is closed. If not, em,ails are sent to the charity to the registered email address held in the Charity Commissions of England and Wales, Scotland and Northern Ireland.

All bank details are stored in the UK, encrypted on the Donatis database.

- 5. Collection closure, payment to the charity(s) and reporting

All collections close 5 weeks after their date of publication. Whilst the funeral notice remains in perpetuity (along with the final total collected plus Gift Aid), the ability to donate is removed and subsequent viewers are advised to donate directly to the charity.

An email is automatically sent to the address supplied when the notice was booked (usually the Funeral Director or the email on the account used to book the notice) to advise the total collected plus the total Gift Aid to be claimed by the charity.

An email is sent to the nominated email address(es) for each charity along with a copy of the charities report. The report lists each individual donation recorded, when it was received and if Gift Aid was claimed. The administration fee and card processing fees are shown as a separate figure for each donation and Gift aid is calculated based on the net donations value (i.e. after deduction of administration and card processing costs). It is up to the charity to claim the gift aid using the form given which is in the correct format for direct submission.

Payment of the collection is made on the next payment run.

• If it’s a single payment it will be our reference number (found on the report) plus the surname of the deceased e.g. 2566 SMITH.

• Where feasible the system aggregates payment to minimise administration for both parties. Aggregate payments will carry the reference used in the email containing the reports.

Where a charity has not provided bank details we will send a cheque along with the report to the address listed with the charity commission. Donatis reserve the right to deduct a further £10 from the collection to cover the administrative cost of having to manually pay the collection in this way.

- 6. Acknowledgement by the charity

We ask that when the funds are received, the charity acknowledge receipt by email to the person placing the notice. These details, including the email address are included in the charities report sent with each payment. The funeral director/individual placing the notice does not supply the details of the next of kin when booking the notice, so we are unable to include this data in the report.

- 7. GDPR - information we pass to the charities

The names and addresses of donors included in the charity report are provided for the purposes of identifying individual donors and enabling the charity to claim the gift aid. Online donors are made aware on the donation form and in the privacy policy and terms and conditions of the service, that they will be disclosed to the charity. The charity may use these details to communicate with the donor to discuss their donation. The person booking the notice/funeral director’s email address is sent to you so that you can confirm receipt of the donations. No explicit consent to receive marketing emails from charities is obtained either from donors during the donation process, or from the funeral director/individual when placing the notice.